Industry 4.0 has been at the centre of economic transformation for a number of years, and together with related technologies has proven to be fundamental in countering the pandemic crisis as well as acting especially useful in assisting companies in the process of technological innovation and environmental sustainability.

In Italy, a government plan was launched for the first time in 2016, which then underwent several revisions until arriving at the current “National Transition 4.0 Plan” that incentivises innovation and grants tax breaks in the form of tax credits with different rates depending on the various categories of tangible and intangible assets.

The Budget Law 2022 regulates the tax credits for investments in the fields of research and development, innovation, and ecological transition, which renewed a series of bonuses and incentives dedicated to companies while also defining the timing and ceiling of the various investments. It also states that:

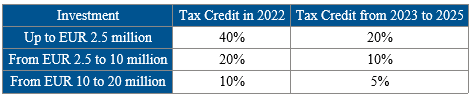

The rates for the purchase of capital goods 4.0 (Annex A, Law No. 232 of 11 December 2016), from 2022 until December 31st 2025, have been lowered with varying percentages depending on the investment. And thus the following tax credits have been recognised:

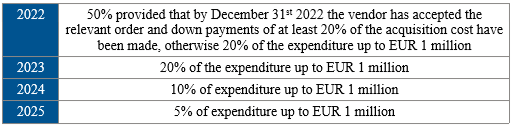

For intangible capital goods, (software, systems and system integration, platforms and applications) related to investments in "Industry 4.0" tangible assets (Annex B, Law no. 232 of 11 December 2016) & expenses incurred with cloud computing services also eligible for the share. The tax credit is applicable until 2026, but with different rates depending on the year:

For intangible capital goods that are not included in Annex B, a tax credit of 6% is applied in 2022 provided that the expenditure does not exceed EUR 1 million.

The tax credits in favour of investments in research and development, capital goods and training 4.0, introduced by the Budget Law 2022 to replace the super-amortization/depreciation, can only be used by offsetting and is divided into three annual instalments of the same amount, starting from the year in which the assets are interconnected.

Enterprises in the state territory regardless of type and economic sector shall be eligible for the subsidies, including agricultural and maritime enterprises, persons with a flat-rate regime, and persons engaged in the arts and other professions. Excluded, however, are all companies with disqualifying sanctions, in a state of liquidation, bankruptcy, an arrangement with creditors without business continuity, or subject to other types of bankruptcy proceedings.

PHC Advisory can offer your company in Italy comprehensive assistance on analysing relevant subsidies, incentives and facilitations that could be applicable to your company, as well as with the relative compliance and support to face issues that your company may encounter in such regards. If you would like to learn more about the latest tax and financial developments in Italy, as well as the applicability and exact details of support measures, please contact us at info@phcadvisory.com.