China’s Ministry of Finance (MOF) and State Tax Administration (STA) have introduced a new preferential corporate income tax (CIT) incentive for companies investing in digital and intelligent transformations of certain types of equipment. To be eligible for the incentive, companies must invest in the digital and intelligent transformation of equipment related to energy and water conservation, environmental protection, and safe production.

What is the special equipment tax incentive?

Between January 1, 2024, and December 31, 2027, companies can deduct the investment made in the digital and intelligent transformation of special equipment from their CIT payable in the current year at a rate of 10 percent. The investment should not exceed 50 percent of the original tax base when the special equipment was purchased.

If the annual CIT payable does not fully offset the deduction, it can be carried forward for up to five years.

It's important to note that companies benefiting from these tax incentives must utilize the transformed equipment themselves. If the equipment is transferred or leased within five tax years after the transformation is completed, the incentives will cease starting from the month when the equipment is no longer in use, and any previously offset CIT must be repaid.

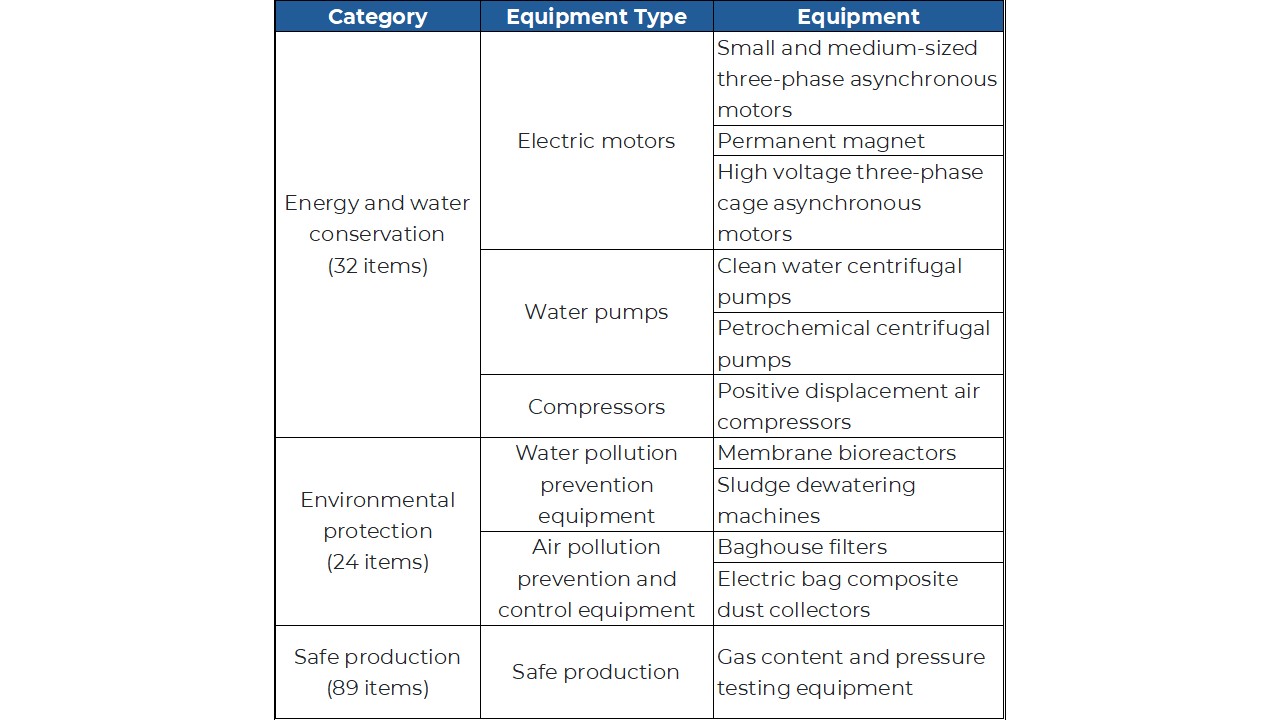

Sample of Special Equipment Eligible for Digital Transformation Tax Incentive

To benefit from the tax incentive, companies must plan the transformation in advance or secure a registered technical development or service contract from a recognized institution. Relevant documentation should be retained for future reference. In cases where tax authorities cannot conclusively determine whether an investment qualifies for the digital and intelligent transformation of special equipment, they may request evaluation by industrial and information technology departments at or above the city level, in collaboration with science departments.

At PHC Advisory, we can offer you full support on matters regarding doing business in China, or any other issues your business may face. If you would like to know more about policies relevant to your business in Italy or Asia, please contact us at info@phcadvisory.com.

PHC Advisory is a company of DP Group: an international professional services conglomerate of companies with approximately 100 experienced professionals worldwide. We offer comprehensive services in tax, accounting, and financial consulting, including financial supervision, financial audit, internal audit, internal control over financial reporting, and support for audited financial statements and annual audits, ensuring clients' financial transparency and compliance.

Would you like to learn more about the business environment in China? Click the link and download our Practical Guides on Amazon!

The content of this article is provided for informational purposes only, financial advice must be tailored to the specific circumstances on a case-by-case basis, and the contents of this article do not legally bind PHC Advisory with the reader in any way.

If you want to know more about doing business in China, please have a look at our previous articles:

US Commerce Department Delays Decision on Vietnam's Market Economy Status-NEWS-PHC ADVISORY

A Guide to Cross-Border Transactions for Management Expenses -NEWS-PHC ADVISORY